Crypto myth: Currently, there are over 19,000 crypto security tokens. DeFi and Web3 seem to be all the rage. It attempts to displace and dislodge the current banking system. The current system has been around since World War I due to the ascension of the United State Dollar as the world’s reserve currency.

Introduction

Unfortunately, the supply of US Dollar has been increasing -- that is, the presses at the U.S. Federal Reserve has been working non-stop. Many reasons drive the US Fed towards increasing the money supply – such as hitting its 2% inflation target. I know that this word, inflation, has new meaning in 2022 thanks the amount of fiscal and monetary support the United States government has provided since 2020, start of the Covid-19 Pandemic.

This endless increasing supply of FIAT money drives inflation and drives devaluation.

In this article, I will debunk some of the misconceptions around crypto currencies. Also, I will discuss ways in which you can invest in Bitcoin.

The Crypto Myths:

Crypto Myth #1: Crypto is digital gold

Early 2022, we learned that crypto is closely correlated to the NASDAQ. As such, it moves in tandem with interest rates anerall sentiment of the market. So, the fact that Gold is stable while Bitcoin has dropped in price hardly makes it digital gold. Bitcoin dropped 75% in 2022 alone after reaching $66,000USD in March 29, 2022.

I’m not saying that Gold is unassailable. What I am saying is that you shouldn’t bet everything you have. Instead, invest what you can afford to lose. Do not stress having to put food on the table or struggling paying for day-to-day living expenses.

Crypto Myth #2: Bitcoin not confiscatable

If you’re storing your crypto in a hardware wallet and you are traveling, there is the possibility that a custom or TSA officer confiscating your hardware wallet.

If you’re are trying to evade taxes, scam or to steal crypto, it is possible for the police and the FBI to capture and recover funds. They can by watching your public wallet address. As soon as you move funds, they will be able to locate and to recover funds.

Source: Two Arrested for Alleged Conspiracy to Launder $4.5 Billion in Stolen Cryptocurrency

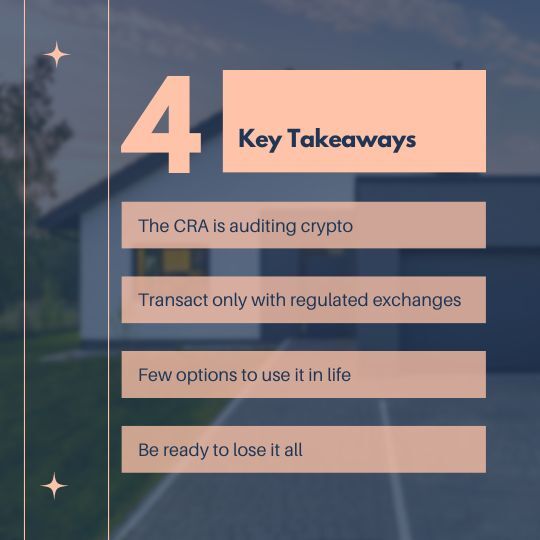

If you have been trading crypto, you have to disclose your crypto trades to the Canada Revenue Agency (CRA), IRS or your country’s tax collector. They are working very hard to track every tax payer who has not paid taxes. For instance, since 2016, the CRA requires that anyone who has been trading crypto and if the amount of invested capital (i.e. cost) is larger than $100,000 CAD, you must declare said holdings by using Form T1135.

Crypto Myth #3: More accepted at restaurants, hotels, etc. than a gold brick

I have not seen one restaurant, hotel or any store that accepts Bitcoin.

Crypto Myth #4: Crypto will stop government reckless money printing

While Bitcoin has a maximum of 21 Million mintable coins, other tokens have an unlimited ability to mint. It’s possible any developer to start a new crypto token. Opening the door for fraud and Ponzi schemes. If you invest in any new crypto token, be sure that you take appropriate safety steps. You also need to understand the cryptocurrency tax situation in Canada as well as your own country.

Crypto Myth #5: Government cannot regulate crypto

Governments are working to regulate by ensuring the crypto on and off-ramps are tracked while protecting investors.

The open nature of the blockchain allows governments to track criminal activities. Tools are available and enhanced to track more criminal activity.

The CRA is actively conducting audits of those investing and trading in crypto-assets. In a 2020-2021 report, the CRA confirmed that it is continuing to improve its crypto-related compliance efforts by implementing specific measures.

Crypto Myth #6: But Bitcoin cannot be censored. Decentralization guarantees that.

At the heart of the 2022 Luna Terra-UST crypto crash was DeFi, or Decentralized Finance. Luna-Terra was known as a algorithmic stable coin. In the case of Luna-Terra-UST, one pair was the stablecoin, Terra-UST. While Luna would fluctuate based on crypto market trade, Luna would mint, or destroy coins to keep the Terra-UST peg against the USD. Without any hard asset backing Terra-UST, it was easy for traders to game it. It drove a mass "bank run". Within four days, Luna and Terra-UST were bankrupt. The pair was backed by Bitcoin. Bitcoin is not a hard asset like Gold or even US Treasuries. The founder, Do Kwon, immediatley, sold all Bitcoin associated with Luna and Terra-UST. He immediately proposed the creation of Luna V2. This time, it would not have any Terra and no backing like Bitcoin. The new coin was relaunched on May 28, 2022. It crashed as those who were airdropped the new token based on ownership of the original Luna, immediately sold.

Backing of a Fiat currency today is based on human faith and demand. Fiat USD has demand because the U.S. Dollar is the world's reseved currency. It's backed by the power of the United States Army, its economy and by countries that use it as a storage and trading currency. In the past, currencies were backed by physical Gold reserves.

Yes, while DeFi may be not censored, bad actors can sketch scams and Ponzi schemes such as Luna Terra-UST.

Now that I have debunked some major misconceptions, may be you are still interested in investing in Bitcoin.

Crypto Myth #7: Centralized Crypto Exchanges are against anonymity

In late 2022, centralized crypto exchange (CX), FTX, suddenly failed. Sam Bankman-Fried(SBF) ran FTX out of the Bahamas where regulations were lax to non-existent. Furthermore, SBF used customer funds from its hedge trading firm, Alameda Research, to fund questionable venture capital startups, pay for sponsorship with big stars like Taylor Swift, Matt Daimon and Kim Kardasian to politician in Washington.

FTX's suddend collapse left millions of investors without access to their funds and some even lost their life savings.

Is Now the Best Time to Buy Bitcoin?

When should I buy Bitcoin? Should I invest in Bitcoin today, or tomorrow?

It is very hard to time any market. In late 2022, the crypto market was down a lot, 75%, in fact. Was that the best time to buy? Instead, here are a few helpful strategies:

- Buy when a regulatory framework is in place

- Buy from regulated crypto exchanges

- Buy before major updates

- Buy before the next “halving” of Bitcoin

Buy when a regulatory framework is in place

As we found out from the FTX and Terra-Luna sudden and flash collapse, investing in cryptocurrencies can be like gambling. It is gambling because it appears that besides BTC and ETH, every other alt-coin has the odds stacked against you. It means that the founders may have backdoors and ways to exit without anyone knowning.

Buy from regulated exchanges

In Canada, the list of regulated centralized crypto exhanges is growing. These are:

Buy before major updates

Similar to Apple or Tesla announcing a new product category or entering new markets, buying into equities or Bitcoin ahead is a sure way to profit. The key question is that there’s still a healthy amount speculation. Do your research before you placing your best bet.

Buy before the next “halving” of Bitcoin

The halving is when BTC miners get paid half as much Bitcoin as before. This happens like clockwork -- once every 4 years. Because supply is trimmed down -- and demand stays the same or increases -- the price is bound to go up!

Table of Contents

- Introduction

- The Crypto Myths:

- Crypto Myth #1: Crypto is digital gold

- Crypto Myth #2: Bitcoin not confiscatable

- Crypto Myth #3: More accepted at restaurants, hotels, etc. than a gold brick

- Crypto Myth #4: Crypto will stop government reckless money printing

- Crypto Myth #5: Government cannot regulate crypto

- Crypto Myth #6: But Bitcoin cannot be censored. Decentralization guarantees that.

- Crypto Myth #7: Centralized Crypto Exchanges are against anonymity

- Is Now the Best Time to Buy Bitcoin?

Related Articles