Cryptocurrency tax: Founded in 2016, our firm has since helped clients across the country to answer questions about buying, investing in and selling cryptocurrencies.

Cryptocurrency Tax Situation in Canada

Forte Innovations is an accounting firm based in Vancouver, BC is one of the top crypto tax firms in Canada.

“When our clients call, they always question whether cryptocurrency is taxable and what determines a tax event”, says Ronny Ko, Managing Partner at Forte Innovations. “The simple answer is yes, crypto is taxable.”

The Canada Revenue Agency (CRA), for example, treats cryptocurrencies as commodities, so businesses selling cryptocurrencies from public kiosks can’t collect GST or HST on their sales.

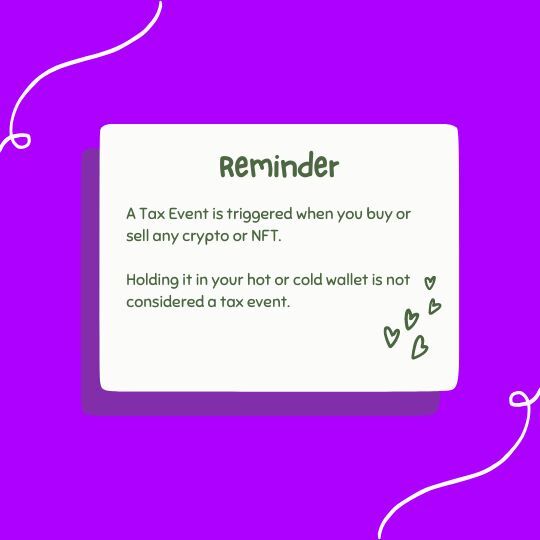

“However, a tax event is triggered when it is traded. A trade can be any event in which the ownership changes. How it gets treated is dependent on the nature of the transaction. If you’re a long-term investor (long-term view) and wait for it to increase in value, but you also ride out the downturns, an increase in the value of that cryptocurrency could represent a capital gain. On the other hand, if you’re actively trading crypto and are seeking fast profits (losses included), it’s considered business income and would be taxed at a higher rate. You can, however, claim business expenses. Business expenses, can lower the taxable income,” said Ronny Ko.

If you invested early in crypto currencies like Bitcoin, and you used the profits to buy another crypto alt-currency like Solana, the amount of that

- Disposal of certain amount of Bitcoin (gain)

- Purchase of Solana (hold)

A tax event is triggered in step 1. However, not step 2 since you didn’t sell it by the end of the tax year.

Can you pay your taxes by using crypto in Canada?

“Currently, the CRA doesn’t accept payments in cryptos”, says Ko. “Your options are pay in cash. If you don’t have cash, you have to sell some of your crypto holdings and convert it back to Fiat. It is very important to have a tax plan, so you can reduce your tax frustrations.

Related Articles