Controller services, the accounting department is the eyes and ears of the company. You are asking "What does a controller do?". In this article, you will learn the key functions of this role. Why you shouldn't confuse it with a CFO or a bookkeeper.

The saying goes “I’m feeling like I’m flying blind”. Personnel with less qualification and experience could lead to:

- tax oversights

- compliance, and

- poor financial outcomes

Having a fractional controller to extend and to enhance the work done by bookkeepers. Many small and mid-sized businesses don’t have the budget to hire a full-time controller. Yet, you need a controller!

It is possible to get the higher-level skills and experience – on demand and when you need them. That’s by hiring a fractional controllerfractional controller (also known as a part-time controller) on a part-time basis.

What does a fractional (part-time) controller services do?

As your business grows and scales, the complexity of the bookkeeping also grows. Having a part-time (fractional) controller can find insights in your financial information.

A part-time controller is a very cost-effective way to manage your growing business. When you're larger, you can hire a full staff controller.

The fractional controller can work with you on a

• single project,

• an on-going contract, or

• as a single or part of an outsourced accounting package.

Fractional Controller vs. Bookkeeper vs. Fractional CFO

Fractional Controller vs. Bookkeeper

There are differences between a bookkeeper and an accountant. A bookkeeper's strength is in processing information and keeping them organized. Handling the computerized accounting system. They also do monthly reconciliations.

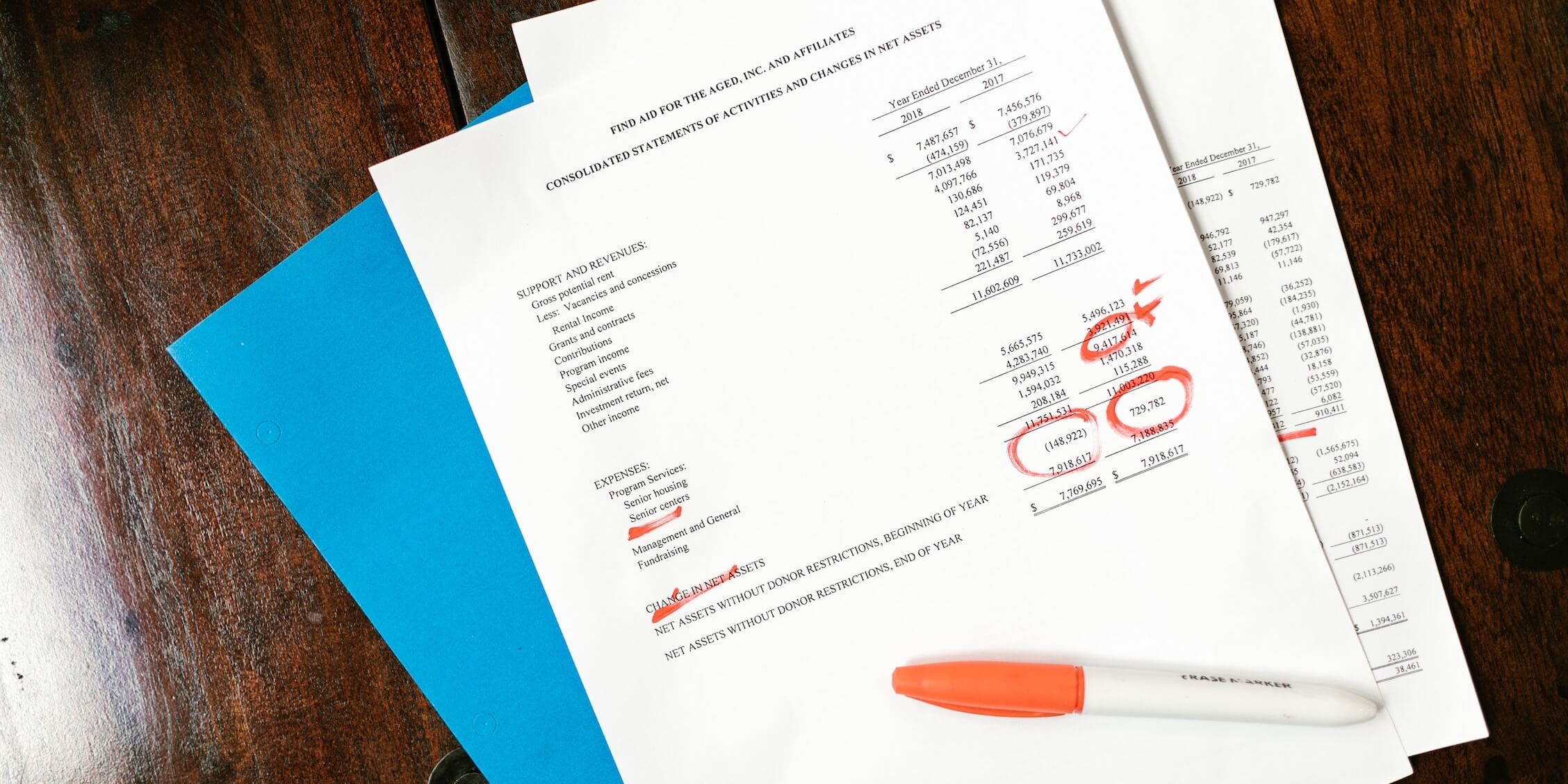

A fractional controller is different from a bookkeeper. A controller focus on business accounting functions. Tying them to match financial to operational performance. A controller helps and supports business leaders with forward thinking ideas. Ideas backed up by financial proofs along with pros and cons.

Fractional Controller vs. Fractional CFO

A CFO (Chief Financial Officer) and a Controller are different roles. CFOs play a key role in accounting by being more focused on business strategy, being tactical. CFOs bring a wealth of experience and contacts to projects. If your business has a strong fractional controller, you often won’t need a fractional CFO.

Is your business ready for outsourced controller services?

Businesses with annual revenues between $500K to $1M should consider hiring a fractional controller.

The fractional controller assist complex bookkeeping transactions to preparing and interpreting financial reports.

If the company gets to $10M in revenues, having controller services is a must-have. That's to ensure internal controls, maintaining, overseeing of the monthly books closing process.

Besides, a fractional controller can help in targeting growth opportunities. It's true in growth companies where there are mountains of opportunities.

A controller can help assess:

- The financial viability of the market or growth opportunity

- The ROI (return on investment)

- Estimate the timeframe on ROI

- Project if there’s enough cashflows to start the project

A controller can help you take a confident step forward back by numbers. It can also instill confidence to banks and debtors and investors.

Sources:

The benefits of working with a fractional controller

These includes:

- Ensure that your statutory remittances to the

- CRA

- WCB/Worksafe/OSHA

- Provincial, state and city are current and up-to-date

- Communicating on your behalf in the event of an inquiry

Controller also help by

- Quarterbacking year-end and to ensure that it’s a breeze

- A fractional controller will be valuable resource for year-end accountants and in-house bookkeepers.

- Meet debt covenants

- Early warning system. Anticipating and communicating in advance when things don’t go according to plan.

- Leverage experience in decision making

- Ensure the financials are accurate. It allows the fractional controller to provide better insights. Enable even better decision making.

- Effective cashflow planning

- Cashflows is the lifeblood of any business. A fractional controller can expect “dry and wet seasons” of cash.

The number one reason many businesses fail is because they run out of cash. Next, is failure to find product-market-fit. With the help of a fractional controller, you will understand your financial data -- in good times and bad.

Contact us today to find out how you can take advantage of Forte Innovations’ flexible fractional controller services. We can help navigate your growth challenges!