Canada crypto tax is triggered whenever a taxable crypto transaction of any type. Tax due is calculated whether it is a capital gain or business income. How much tax is due is dependent on each individual scenario.

Table of Contents

- Is crypto taxable in Canada?

- Are cryptos tax free in Canada?

- This guide is regularly updated

- Can the CRA track me?

- What is the likelyhood of being selected for a crypto audit?

- What is the treatment of crypto tax in Canada?

- Are my Crypto Activities Business Income vs. Capital Gains?

- Consideration for Minimum Tax as alternative to Regular Capital Gains

- What cryptocurrency and alt-coin activities is considered as carrying business?

- My employer pays my salary in crypto, what are my tax consequences?

- What is the difference between a business vs. a hobby for crypto tax?

- What do you need to get started with crypto taxes?

- How much tax on crypto Canada?

- What are the banned crypto exchanges in Canada?

- Is Binance legally banned in Canada?

- What are the approved exchanges in Canada?

- Are there crypto tax breaks?

- How is NFT taxed in Canada?

- What should you do?

The Canada Revenue Agency has guidance for cryptocurrency taxation. The guidance are not always black and white. Our Crypto Tax guide aims to offer clarification for filing taxes on crypto capital gains, crypto income, and how to calculate, report your crypto to the CRA ahead of the April 30th tax filing deadline. |

Is crypto taxable in Canada?

Yes, The CRA generally treats cryptocurrency like a commodity for purposes of the Income Tax Act. Any income from transactions involving cryptocurrency is generally treated as business income or as a capital gain, depending on the circumstances. Similarly, if earnings qualify as business income or as a capital gain then any losses are treated as business losses or capital losses.

Are cryptos tax free in Canada?

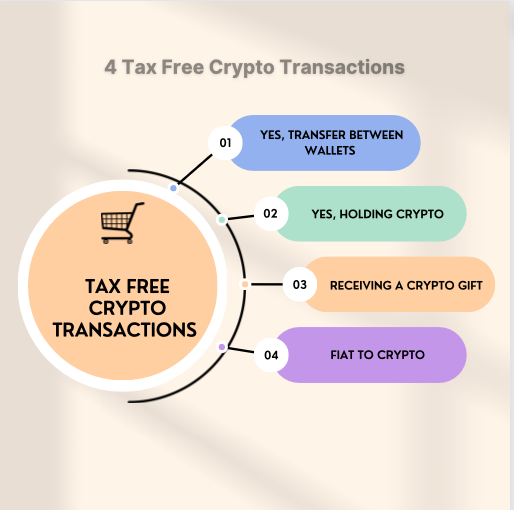

There are some bright spots that allow cryptos to be tax free in Canada. These are:

You won't be paying tax if you do these transactions:

- Transfer between wallets: cold to cold or cold to hot and hot to cold as long as these belong to you

- Hodl: Holding crypto after your have received them is tax free

- Gifting: If someone sent crypto as a gift to you but the gains after receipt are not tax free

- Conversion: Converting from FIAT to Crypto in considered a financial transaction which are tax free under the Excise Act and also GST/HST free.

This guide is regularly updated

One quick thing before we jump into it - the rules on crypto tax in Canada are in constant flux. At Forte, we keep a very close eye on the CRA's crypto policies and regularly update this guide to keep you informed and tax compliant.

- 4 Feb 2025: New CRA guidance and deadline extensions

- 10 January 2024: Tax must be filed or post marked by Tuesday, April 30, 2024

- 22 February 2023: Crypto Exchanges Doing Business in Canada need to Assure Regulators

- 13 January 2023: April 30, 2024 falls on a Sunday. Tax Filing deadline will be on or before May 1, 2023.

- 23 February 2022: Tax-filing season is open. Deadline is 2 May (as 30 April falls on weekend)

- 20 January 2022: Updated to include the newly released Schedule 3 for the 2021 financial year.

- 7 December 2021: New year, new guide for 2022!

- 25 March 2021: Coinsquare ordered to release customer records to CRA.

- 10 November 2020: CRA announces 2021 filing deadline as 30 April 2021.

- June 1, 2020: All cryptocurrency exchanges must register with FINTRAC

Can the CRA track me?

Yes. As of June 1, 2020, all crypto exchanges operating in Canada must be registered with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). In turn, the CRA is registered with FINTRAC. FINTRAC regulates financial institutions and investigates money laundering and tax evasion.

Similarly, on January 1, 2022, all money dealing services business in Canada have to notify the CRA of any transaction over $10,000. This means that if you send $10,000 to any crypto exchange operating in Canada, the bank will report it to the CRA.

When you open an account in Canada, FINTRAC requires that the exchange obtain and verify your identity. This means that your ID is linked with your wallet at the exchange.

Besides, Coinsquare, the CRA hasn't published a list of exchanges that it's working with.

The best way to stay tax compliant is to report your crypto taxes.

What is the likelyhood of being selected for a crypto audit?The Canada Revenue Agency has confirmed that it is contacting cryptocurrency investors to inform them of pending audits. We have seen that those chosen for a crypto tax audit will receive a 13-page form filled with questions about their crypto transactions. These questions are both quantitave and qualitative. It will require the assistance and teamwork of a crypto tax accountant and crypto tax lawyer. The quantitave module require that you have crypto transaction records in order to base your claims. Remember that once you're selected by the CRA, the onus is the taxpayer to proof your innocence, which is opposite from a court of law. The best way to protect yourself from an audit is by accurately disclosing your crypto trading activities. Tools like Koinly and CryptoTaxCalculator are not very good at capturing the vast arrays of trading and usage scenarios. Each one has their own strengths and weaknesses. Use them, but engage the services of a crypto tax accountant like Forte Innovations Crypto Tax Accountants to review and to work with you to ensure that there are no missing transactions that would have been easily been missed. If you're a business and transact in crypto, you should make sure that your business is also properly accounting for crypto during bookkeeping. |

What is the treatment of crypto tax in Canada?

Crypto tax in Canada is based on self-assessment and disclosure. How you classify -- whether you’re carrying a business or capital gains will be determined by -- but not exclusively, the following rules:

- you carry on activity for commercial reasons and in a commercially viable way

- you undertake activities in a businesslike manner, which might include preparing a business plan and acquiring capital assets or cryptocurrency inventory

- you promote a product or service

- you show that you intend to make a profit, even if you are unlikely to do so (i.e. lost money) in the short term

To be classified as a business, you have to regularly and frequently transact in cryptos, NFTs and alt-coins. The CRA doesn’t have a set number of transactions that would help a taxpayer because no two taxpayer is created equal. it’s up to their professional judgement.

When you start your business also has a weigh. If you’re still setting up your business, the CRA may not consider that you have started the business. A business may be considered started once the business has significant activity related to “earning income”.

Are my Crypto Activities Business Income vs. Capital Gains?

There is no clear definition like a date or number of transactions to arrive at a result on whether to designated your crypto activities as one of the other. We have prepared a detailed article that talks about the nature and determination of your crypto tax activities are business income or capital gains.

Consideration for Minimum Tax as alternative to Regular Capital Gains

If you have made a lot of profits in your crypto trading, you should ready this article because you may be taxed differently under new rules passed in the 2023 Budget and updated for 2024 tax years, respectively because you may be subject to the Alternative Minimum Tax (AMT)

What cryptocurrency and alt-coin activities is considered as carrying business?

The following activities would fall into the purview of taxable business activities:

- cryptocurrency mining

- cryptocurrency trading

- cryptocurrency exchanges, including ATMs

- NFT trading

My employer pays my salary in crypto, what are my tax consequences?

In early 2022, the CRA does not have an official guidance on the treatment of salaries paid in crypto. To be tax compliant, we recommend talking a tax lawyer who understand crypto.

Generally speaking, if you're earning income, the crypto should be converted into Canadian Dollars equivalent when it is earned/paid to you. Similarly, payroll taxes should be deducted and remitted to CRA according to your assigned scheduled by the CRA. If you're self-employed, should be withhold taxes or pay them according to a CRA provided schedule.

The New Zealand crypto tax model for salary is one called Pay As You Earn (PAYE) tax system — in which employers deduct tax and other payments before wages are paid. Would Canada Revenue Agence (CRA) adopt a similar model? It is a resonable notion. We recommend talking to a tax law professional.

Reference: New Zealand tax authority approves crypto salaries

What is the difference between a business vs. a hobby for crypto tax?

The distinction between HOBBY AND BUSINESS trading has major tax implications. If the cryptocurrency transactions in question are being conducted as a hobby, then any gains made are capital in nature. This means that only 50-percent of those gains will be taxed. If these are business transactions, then 100-percent of the gains are taxed, just like business income. Having said that, as a business, you can also claim an array of business deductions.

The Canada Revenue Agency considers each taxpayer’s case individually.

What do you need to get started with crypto taxes?

Before you start doing your taxes, you need to grab your data from the exchanges like Binance, Koinly, Bitbuy and others, that you've used in the last year. Learn more about what data is needed to do crypto tax.

The information will help calculate the adjusted cost (ACB). That's the cost paid to obtain your crypto assets. Any transaction fees will be deducted from your costs.

On the other hand, if you were gifted cryptos, your adjusted cost based will be zero. This means that your entire proceeds on disposal will be taxable.

Check our Tax Filing Checklist on what you'd need to file your taxes with us.

How much tax on crypto Canada?

How much tax on crypto gains in Canada is very dependent on your individual tax situation and province of residence.

Let's consider that you're in the capital gains group, where you have been holding and not daytrading. In Canada, 50% of the gains or losses will be qualified as taxable gains or losses. If you're paying taxes, you have to pay them in the tax reporting year. On the other hand, if you've lost money, the loss can be carried forward indefinately. The loss carryforward can be used against any gains in future years gains. Thus, lowering your taxes. In other words, the government takes taxes when you gain but lets you have a "loss credit" when you've lost capital. Unlike many other countries, short-term and long-term capital gains are taxed the same way in Canada.

The declaration is done in the annual individual tax return. In addition, how much tax on crypto is dependent because Canada is on a progressive tax system. It means that we need to look at your entire tax situation first. Generally speaking, the more you make, you more you pay.

We recommend taking a look at the tax tables at TaxTips.ca.

What are the banned crypto exchanges in Canada?

Canada doesn't have a unified securities and exchanges commissions unlike the US, which has the Securities and Exchange Commission (SEC) or the Commodities Securities and Exchange Commission (cSEC). As a result, there is a patchwork of laws and regulation around crypto exchanges. There are cases in which an exchange has been banned in Ontario, they setup in other provinces. Generally speaking, the largest crypto exchange in the world is Binance. Binance had been banned operating in Ontario. Generally, other provinces follow the lead of the Province of Ontario. However, Canadians are still able to access their Binance accounts. When you are dealing with exchanges that are not regulated in Canada, there are no protection and it doesn't prevent these exchanges from using your money for corporate use, fraudulent activities which can cause a "run on the bank" scenario. The most famous exhanges to go bust was FTX in 2022.

Is Binance legally banned in Canada?

In 2021, the Ontario Securities Commission (OSC) accused several crypto exchanges of not being compliant with securities regulations in the province. These exchanges included Binance, Poloniex, and KuCoin. While the other two exchanges ignored the OSC’s request to halt operations or comply with regulations, Binance decided to cease operations in Ontario.

As of January 2023, Binance is completely banned from doing business in Canada.

On October 2023, Binance left the Canadian market all together.

What are the approved exchanges in Canada?

Your best bet for a secure crypto exchange is to use a Canadian crypto exchange that is registered and licenced in Canada. Among the most popular are:

Are there crypto tax breaks?

1. 50% of your crypto gains are taxable:

When you calculate your crypto taxes (assuming that you're claiming capital gains and not running a crypto business), half of your gains/losses are used to calculate taxes at your combined Federal and Provincial tax rates. The easiest way is to add up all your capital gains and then halve the amount. That's how much you'll pay tax on. First you need to have accurate numbers. Our experience is that software packages such as Koinly and Crypto Tax Calculators, that claim to calculate your crypto taxes are in their infancy. The numbers can swing wildly. Thus, clients reach out to us to help them calculate their cryto gains and losses, which they can use to file their own income taxes or give them to their accoutants; we can also help.

2. Personal tax allowance:

In 2023, the first $15,000 earned is tax free in Canada. In 2022, the allowance was $14,398. The CRA increased the BPA (basic personal allowance) to $15,000 in 2023 from $14,398 in 2022, lowering your tax bill by $2,225 (15% of $15,000). The allowance is usually increased every year to allow for inflation.

3. Spousal Tax Credits:

Each year, the CRA updates the amount of Basic Personal Amount (BPA), if you don't use them, you can transfer them to your spouse as long as you're married or in a common law relationship. For example, if you earn $70,000 a year and your partner earns $10,000 a year, you’d be able to claim the difference between your partner’s income and the BPA - in this example, $4,398.

4. Donation credits:

If you are the donating type, you can reduce your crypto tax due by donating. You can claim your donations amount up to 75% of your net income with some exceptions. You can also gather all your donation receipts for up to 5 years to get a biggest bang rather than claiming them in the year the donation was made. It could drop you to the next lower tax bracket!

How is NFT taxed in Canada?

NFT is taxable in Canada. The general idea is that NFTs are taxed when you do the following:

Buy goods or services using an NFT

Sell NFTs for either fiat or cryptocurrency

Trade NFTs for other NFTs

Gift NFTs to someone else

The CRA effectively only taxes your NFTs when you realize some sort of profit from your digital assets, either by selling them for fiat or cryptocurrency or by trading them for some other commodity.

Furthermore, like stocks, there is no tax on NFTs if they are simply sitting in your digital wallet. In this case, your NFTs function similarly to stocks in your brokerage account. They can fluctuate in value, but you won't have to pay taxes on them until you sell them for a profit.

As of January 10, 2024, NFT trading has faded. Most people who have traded NFTs are looking at near or total losses.

READ More:

What should you do?

Wherever your cryptocurrency activities fall, it is advisable to talk to an accountant. Paying for an accountant’s advise will asure that the solution will be tailored to you and will be 100% true.

We recommend that you have all your crypto data organized and put together so your conversation with an accountant will be quick and effective of your time and investment. Please read the article on Dealing With Crypto Tax and Accounting for tips on how to gather your data.

References: Guide for cryptocurrency users and tax professionals